Last month I hosted a workshop with 25 senior executives from companies around Australia at the third annual NG Customer Experience Summit. There was a wide variety of experience levels amongst the participants and a range of topics related to CX covered. My aim in this workshop was to discuss research-based CX strategies with the group and offer advice in the transition to actionable (and achievable) roadmaps. Here is a rough summary of what we covered.

Strategy begins with research

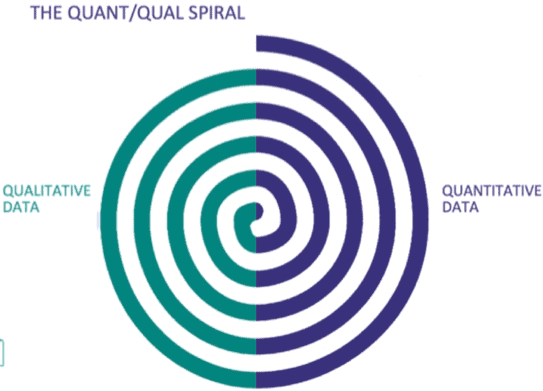

We can’t develop a strategy without data. When looking to uncover useful information about customers and their needs from an organisation, we start with customer research to collect this data. We can collect two types of data:

- Quantitative data such as website analytics or customer survey responses. Essentially, any aspects of the customer experience that are measureable; and

- Qualitative data. Customer information that can’t be measured but tells us about their behaviours, motivations and feelings about their experiences with your organisation.

Quantitative data provides you with amounts and percentages. Qualitative data is used to add depth of understanding to these numbers, which can then be validated by additional quantitative research. You can begin with either, but should collect both to ensure accuracy when attempting to understand customers well enough to develop valuable products, services and experiences for them.

Theoretically, a cycle of both types of research could go on forever but the amount of new information you will uncover versus the number of rounds of research you conduct follows the law of diminishing returns.

The quant/qual spiral represents the ideal that qualitative and quantitative data could be used to validate each other a limitless amount of time in the effort to understand your customers.

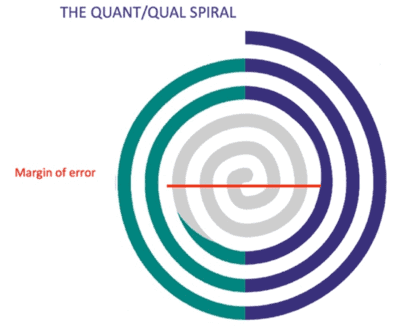

There becomes a point when the amount of effort to uncover additional data exceeds the value of that data. The remaining information you do not have becomes your margin of error. A good researcher should be able to identify how much (s)he needs and develop an approach accordingly. Often a round or 2 of each is enough to help paint a fairly accurate picture of your customers. Especially as you are most likely to be working toward a “moving target” as there will be changes in customers and their behaviours over time. Just be wary of the impact of budget and time constraints as they might lead you to make some dangerous assumptions.

What you do not know about your customers becomes your margin of error. A high margin of error could lead to dangerous assumptions about your customers.

The following examples come from actual projects and demonstrate the errors we end up with when we don’t follow at least one complete cycle of qual and quant. In the cases below, the client started with quantitative data and we used qualitative research to investigate further. I presented these to the group and asked what might be happening.

Example 1: “Website analytics of our online tool shows that users are dropping out of the process before getting to the final step.”

- Workshop participants speculated causes for this:

- It is too long/ there are too many steps

- User is running out of time and are abandoning his/her task

- User is getting bored and abandoning his/her task

- It is difficult to complete

- It is broken

Qualitative investigation uncovered the true cause: Users did not need the last step offered by the tool. They felt their task was accomplished by reaching the second to last step.

Example 2: “Our Call Centre data has revealed that most people are only visiting our website to get our phone number so they can call us.”

Workshop participants speculated causes for this:

- Customer can’t do what (s)he needs to do online

- Customer thinks (s)he can’t do what (s)he needs to do online

- Customer prefers to speak to people because (s)he is scared of technology

Qualitative investigation uncovered the true cause: Customer trusts a person’s word more than a digital process for ensuring things like filing an insurance claim.

Employing research findings to make positive changes

A good research plan will incorporate both quantitative and qualitative findings. It will also employ multiple research methods (e.g. one-on-one interviews, workshops, surveys, etc.) to ensure a well-rounded understanding of your customers, their behaviours, actions, needs, motivations and aspirations.

Research findings should leave you with a list of insights to put forth into a strategy and then toward the creation of tactical projects. A Customer Experience Strategy isn’t much different from any other type of strategy you might develop. The steps look roughly something like this:

- Group together similar insights that define your customers and their relationship with your organisation. You might see a reason to link together findings related to the digital experience, identify common motivations and needs for using your services and/or note key differentiators that bring customers to your organisation or send them away.

- Utilise the insight groups to create a set of themes or guidelines to form a strategy. In the past, we have used insights such as “poor user experiences are leading to a lack of trust in the website” and “a general lack of understanding of the organisation’s intention is leading to confused and frustrated customers” to develop goals like “Build trust in our digital presence” and “Identify and communicate our product’s core value”.

- Identify. CX projects to undertake to help the organisation meet its strategic goals. Match current projects to the goals you have identified, ensuring that they as well as any CX-related projects moving forward are contributing to your strategy.

- Prioritise projects and develop an implementation plan. This can often be accomplished with the development of a roadmap. I often host roadmap workshops with clients where we spend some time identifying projects, listing out any dependencies and identifying responsible parties.

We had a go with this in the workshop using the following template. It doesn’t always matter how much you understand about the project’s complexity, but it does always need to fit in with your strategy.